Methodological Approach

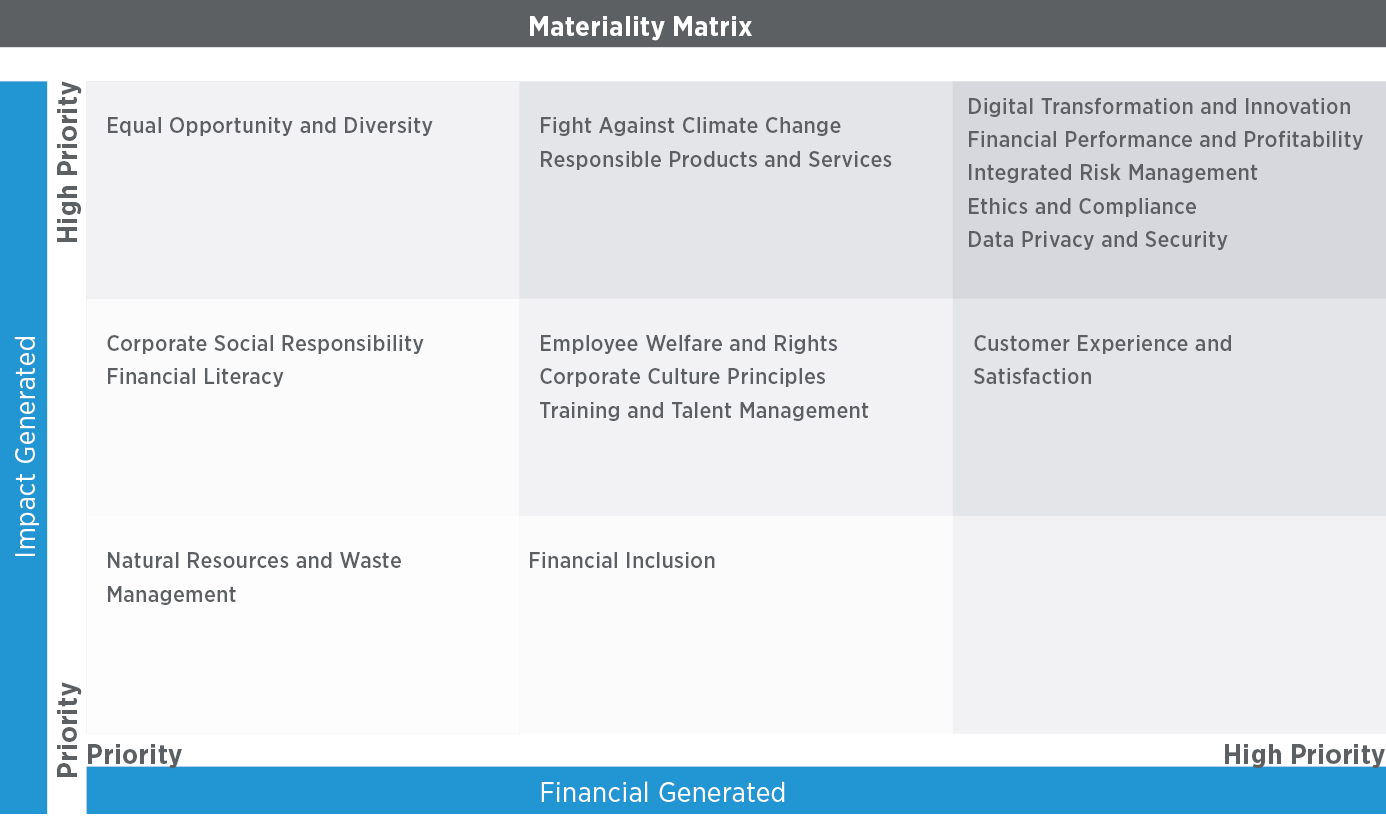

By considering the Bank's short, medium, and long-term strategy, Strategy Plan 2022-2025, and business model, as well as developments during the reporting period, the Ziraat Participation materiality analysis was conducted. The material topics, which are the outputs of the stakeholder analysis, form the basis of the 2023 Sustainability Report.

The purpose of the materiality analysis was to compile a comprehensive and up-to-date list of topics, and during the process of identifying the material topics, the main patterns in the national and international banking and finance sectors, global megatrends, and developments in sustainability reporting frameworks were analyzed.

The Strategy Planning and Sustainability Team of the Bank, as well as senior management from Ziraat Participation and other department managers of strategic significance, collected views on material objectives and future strategies and incorporated them into the analysis.

The final stage involved a review of all data obtained during the workshop organized with the Sustainability Committee participants, and the ranking of material topics.

The materiality of the topics for stakeholders and the extent to which the relevant topic would be material for the Bank were assessed within the context of the materiality analysis. In addition, the database was used to compile and analyze the suggestions, appreciations, and complaints that customers, employees, and other stakeholders submitted to the Bank through various channels during the reporting period, contributing to the materiality study.

As a result of all these evaluations, Ziraat Participation has successfully developed a materiality matrix that focuses on sustainability and ESG axes.

The Bank will regularly review the materiality matrix to ensure that it aligns with changes in its operational framework and any necessary updates.

Material topics that have a very high impact on stakeholders and Ziraat Participation's performance

Digital Transformation and Innovation

Ziraat Participation is currently focusing on improving its technological infrastructure and digital product introduction capabilities in response to the growing influence of artificial intelligence in the business and life cycle. In order to achieve this objective, the Bank establishes end-to-end digital processes, enhances the accessibility of financial products, positions its products and services in various channels, and strives to increase its competitive share.

Control Mechanism

The material topic is periodically monitored by the Ziraat Participation Strategy Committee and the Information Systems Steering Committee.

Financial Performance and Profitability

According to the principles of participation banking, Ziraat Participation's financially healthy, continuous, resilient, and competitive performance is critical in terms of its corporate sustainability, as well as its contribution to the development of the Turkish economy and the welfare of its stakeholders. The Bank's financial performance and profitability are also critical and indispensable priorities in terms of the implementation of strategic goals and projects that are based on the sustainability and ESG axes.

Control Mechanism

The management of material topics is conducted in collaboration with all departments of Ziraat Participation. The activities related to these topics undergo periodic reviews by the Active Passive Committee and the Board of Directors. The relevant processes and outcomes are also subject to internal audit, independent external audit, and public audit.

Integrated Risk Management

Operating within the framework of the risk management legislation in force in Türkiye, Ziraat Participation addresses the macroeconomic conditions that are shaped globally and locally within the axes of effective and integrated management of financial and non-financial risks through the risk management cycle. In terms of non-financial risks, the Bank is committed to actively managing climate risks and opportunities. Furthermore, the Bank's Integrated Risk Management diligently monitors risks associated with earthquakes and other natural disasters unrelated to the climate crisis.

Control Mechanism

The material topic is overseen by the Internal Systems Group Presidency, affiliated with the Audit Committee at Ziraat Participation.

Ethics and Compliance

Ziraat Participation focuses on knowing its customers (Know Your Customer-KYC) and maintains interactions with them in compliance with the legal framework and ethical norms. The Bank prioritizes the safety, security, and legal compliance of customer transactions and considers the prevention of financial and economic crimes (money laundering, the financing of terrorism, bribery, and corruption) as its duty.

Control Mechanism

The material topic is overseen by the Internal Systems Group Presidency, affiliated with the Audit Committee at Ziraat Participation.

Data Privacy and Security

In order to protect the privacy and security of customer and bank data, Ziraat Participation strives to uphold a best-in-class cybersecurity infrastructure that focuses on identifying emerging risks and consistently enhancing the security of its systems. This approach encompasses a holistic information security management strategy that includes comprehensive security policies and standards, a robust security awareness and training program, and the deployment of advanced and layered defense mechanisms.

Control Mechanism

At Ziraat Participation, the material topic is managed by the Information Security unit, which operates under the supervision of the CEO. The activities are subject to audits conducted by the Internal Systems Group Presidency and Banking Regulation and Supervision Agency (BRSA). Pertinent processes are also subject to ISO 27001 audits.